SNA Measurement of Real Income: An Application to North American Economies

|

The Stiglitz-Sen report on measurement of economic progress provides an impetus for examining the type of information statistical agencies present, as well as the focus of economic measurement. This paper follows recommendations contained in the System of National Accounts 1993 (SNA 1993) for calculating aggregate real income statistics rather than aggregate real GDP to demonstrate the utility of currently produced National Accounts data. The paper includes adjustments for relative prices referred to as a trading gain (the combined effect changes to the terms of trade and changes in the ratio of traded to non-traded goods prices), and for current account entries other than the trade balance. These adjustments can be made using widely available National Accounts information at minimal cost to statistical agencies. The paper follows the SNA 1993 recommendations and calculates real income for Mexico, the US and Canada. The results illustrate the extent to which nonproduction factors like relative prices can influence the progress of a nation, either compared to other nations or based on a nations ability to purchase the goods and services its citizens consume. Key words: Aggregate Income, Terms of Trade, Real Income, Balance of Payments. |

El reporte Stiglitz-Sen sobre la medición del progreso económico proporciona un impulso para examinar el tipo de información que las agencias estadísticas presentan, así como un enfoque de medición económica. Por lo tanto, este artículo sigue las recomendaciones contenidas en el Sistema de Cuentas Nacionales (SCN) 1993 para el cálculo del ingreso real agregado en vez del PIB real, para demostrar la utilidad de los datos de cuentas nacionales actualmente producidos. El documento incluye ajustes para los precios relativos referidos, como ganancia del comercio (el efecto combinado cambia los términos del comercio y la proporción de los precios de bienes comercializados y no comercializados), y para las entradas a la cuenta corriente diferentes de la balanza comercial. Estos ajustes pueden hacerse usando la información de cuentas nacionales ampliamente disponible a un costo mínimo para las agencias estadísticas. El artículo sigue las recomendaciones del SCN 1993 y calcula el ingreso real para México, Estados Unidos de América y Canadá. El resultado ilustra hasta dónde los factores de la producción influyen en el progreso de una nación, comparado con otras naciones o basado en la habilidad del país para comprar los bienes y servicios que sus ciudadanos desean. Palabras clave: ingreso total, condiciones de negocio, ingreso real, balanza de pagos. |

Introduction

The Stiglitz-Sen report highlights difficulties statistical systems face when producing measures of economic activity. As the report emphasizes, there is no one-size-fits-all measure that can be employed for examining all the facets of society that interest social sciences and policy makers. Nor is it straight forward to aggregate diverse statistics on, for example, market activity, non-market activity, health status and education outcomes into a single, easily interpreted aggregate variable.

The current measurement system embodied in the 1993 System of National Accounts (SNA 1993) is geared towards measuring market based transactions. With the exception of a few places, notably owner-occupied dwellings, measures of gross output, intermediate inputs, and, therefore, gross domestic product, are based on statistical surveys, administrative sources and censuses. Basing the measurement system on verifiable data reduces the extent to which estimates of economic aggregates can be arbitrarily adjusted by statistical agencies and produces measures of economic activity that correspond closely to the variables that decision makers in central banks and finance departments need to conduct policy. As the Stiglitz-Sen report argues, however, the measures of gross domestic product necessary for fiscal and monetary policy will not necessarily correspond to the experiences of individual citizens.

Nevertheless, basing measurement on market-based activity does not diminish the SNA 1993’s usefulness for analyzing the progression of nations. The SNA outlines a complex set of interactions that go beyond GDP and encompass savings and investment activities, wealth accumulation and the balance of payments. The Stiglitz-Sen report can make it seem that entire new measurement systems are necessary while the reality is that many of the recommendations about economic data in the Stiglitz-Sen report can be met, or the first steps can be taken, with data already collected for the proposes of measuring national income in the SNA framework. Measures of household wealth accumulation, gross and net saving and methods to include terms of trade adjustments are all present. However, these metrics are not as widely known or discussed as GDP.

In this paper I will demonstrate how using the SNA’s recommendations for including a terms of trade adjustment and income flows in the current account can both increase understanding about how economies progress, and increase the utility of the data collected for measuring GDP. The current measurement system can be used to produce measures of real income that come closer to the notion of welfare in that they correspond to changes in the utility or well-being of a representative agent rather than changes in their production. While these real income measures do not address the distribution of income, they can provide important information on aggregate economic performance beyond production based measures. Moreover, because the SNA 1993 recommended real income adjustments be derived from estimates used to calculate current production based measures, they can be readily produced from existing data at minimal cost to statistical agencies.

The remainder of this paper outlines the SNA 1993’s recommendations and then follows those recommendations by making use of publically available data from the OECD. The paper is split into two sections. The first discusses how to move through the system of national accounts to arrive at differing measures of income. It follows the recommendations in Section K Measures of Real Income For the Total Economy that correspond to relative price and current account adjustments spanning paragraphs 16.148 to 16.161. The adjustments performed are the addition of a trading gain to capture the influence of the terms of trade and adjustments for net current account flows other than the trade balance. The second section calculates the different measures and compares the results with economic aggregates, and makes cross country comparisons between Mexico or Canada and the United States.

2. Real Income in the System of National Accounts

The System of National Accounts 1993 (SNA 1993) contains a series of recommendations for moving from a production based measure of real incometo a purchasing power based measure of real income. The adjustments contain two major components. The first pertains to nominal income adjustments for international income flows captured by the current account of the balance of payments; the second relates to the deflation method for measuring real income.

2.1. Nominal Income Concepts

A central concern of the SNA 1993 is measuring Gross Domestic Product (GDP). GDP is a measure of production that follows movements in firms’ ability to generate income through the process of transforming inputs into outputs. In a balanced system of national accounts based on a set of input-output tables, this nominal income can be calculated in three ways, and the interconnected approaches form the foundation for SNA real income measurement.

The starting point for measuring GDP is the input-output system that lies at the core of the SNA 1993. In the input-output system, GDP is a measure of value derived from subtracting intermediate inputs from gross output:

Where vj and pj are the volumes and prices for the J commodities produced and ui and pi are the quantities and prices of the I intermediate inputs purchased by firms. While there is overlap between the J outputs and I inputs that correspond to intermediate items produced within an economy, goods and services delivered to final demand, and imports of products not produced in the home country, need not be outputs and inputs of the domestic economy.

Gross output in the input-output system is equal to the final value of all goods and services sold on markets by firms. The production processes that firms employ use capital and labour to transform intermediate inputs into outputs. When intermediate inputs used in production are netted off of gross output, the remaining balance is the income that accrues to capital and labour – the inputs that the SNA 1993 refers to as the primary factors of production. As a result, value added is equal to the income that accrues to capital and labour in each period which gives rise to the income approach to GDP measurement:

Where lm and kn are the labour and capital inputs, respectively, and wm and rn are their corresponding prices.

The SNA 1993 also uses a set of matrices in its input-output system that corresponds to a set of final expenditures by agents within an economy. This is the approach to estimating GDP most familiar to users of national accounts data. The final expenditure categories measure the value of expenditures made on final goods and services by domestic and foreign agents less imports:

![]()

The equality between measures of GDP illustrates two key features of the SNA measurement system.

The first is that income in the system is a measure of value added. It is not a measure of output, but a measure of production. The second is that income is equal to the final value of sales (C+I+G+X) less purchases (M) so that the expenditures on final goods and services in an economy is equal to the income that an economy produces. A recognition of the relationship between expenditures, income and value added provides the basis for real income measurement in the SNA which then sets forth a series of recommendations for adjusting GDP for current account entries in the balance of payments and for the use of different deflation methods that produce real income measures other than real GDP.

2.2. Income Concepts

The most commonly published and discussed real income measure is real GDP. Real GDP is a measure of the real income that an economy generates through production measured in terms of the netputs of goods and services produced. This is the appropriate deflation technique for examining production related phenomenon like productivity growth, capacity utilization or business cycles.

To move to real income measures that are more closely associated with well being it is necessary to make adjustments for relative price changes and international income transfers. These changes affect the underlying income concept (production or purchasing power) and the position of an economy’s budget constraint.

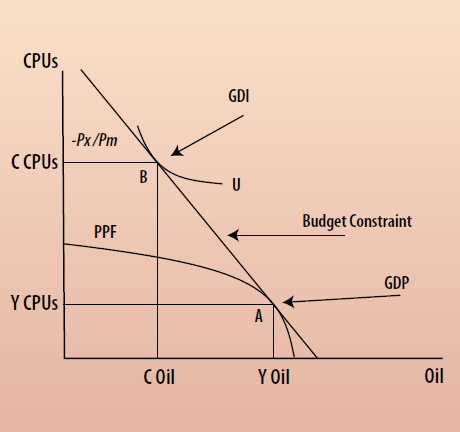

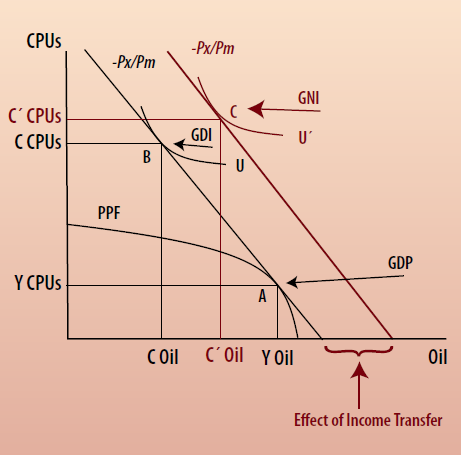

When relative price changes associated with traded goods are incorporated into a real income measure, the result is referred to as real Gross Domestic Income (GDI) by the SNA 1993. Real GDI is a measure of the goods and services available to an economy for consumption and investment. It can be interpreted as a measure of the purchasing power of real GDP. Moving from real GDP to real GDI is equivalent to changing the focus of real income measurement from a point on an economy’s production possibilities frontier to a point on an economy’s utility curve (Chart 1).

Chart 1

GDP vs. GDI

Measurement of real GDP depends on the real income that is earned through production while real GDI depends on what that income can purchase. The GDP deflator, therefore, accounts for all prices while the GDI deflator only uses prices for consumption and investment by public and private sector agents. As a result, in an economy where export and import prices progress at different rates, changes in real GDP and real GDI do not have to increase at the same rate. In fact, as Figure 1 can be used to show, it is possible that real GDI increases while real GDP remains unchanged when terms of trade improvements occur.1

The use of different deflators moves measurement from real GDP (Point A) to real GDI (Point B). However, the capital and labour of a country does not necessarily reside within that country’s borders. When, for example, a firm’s foreign direct investments earn profits that are repatriated, a country’s income may rise but not its production. Similarly, when residents of an economy emigrate abroad and then send money home to relatives, or when governments provide foreign aid, the income transferred abroad can increase or decrease an economy’s consumption possibilities.

By incorporating net primary income flows the SNA 1993 arrives at a real income concept referred to as real Gross National Income (GNI).2 Net primary income flows measure payments for the use of domestic labour and capital abroad less payments to foreigners for the use of their labour and capital in domestic production. The net primary income flows are referred to as net income from abroad (NIFA).

Similarly, an adjustment can be made for net current transfers (NCT), like remittances or foreign aid. When NIFA and NCT are incorporated into aggregate income measurement, a real income concept referred to as real Gross National Disposable Income (GNDI) is generated. In each case, the GDI deflator is applied to the income flows. The adjustments influence the economy’s budget constraint, raising or lowering it relative to the income produced through domestic production (Chart 2). The income transfers represent international claims on goods and services and lead to real income measures where the current account of the balance of payments, not just the trade balance, is incorporated into real income measurement.

Chart 2

Effect of a Positive Net Transfer

2.3. Income Calculations

Real income index calculations in this paper are based on an assumed equality between income based estimates of GDP and final-expenditure-based estimates. The discussion of income estimation begins by examining different ways of adjusting a society’s budget constraint to form different nominal estimates of aggregate income. Subsequently, a discussion of real aggregate income estimates is provided.

2.3.1. Nominal Income Aggregates

The starting point for index number derivations based on GDP is a set of inputs and outputs from the production processes that can be divided into domestic outputs, exported outputs and imported inputs: N = ND + NX + NM (see for example Diewert and Morrison 1986 or Fox, Kohli and Warren 2002). If one assumes these netputs can be represented by a netput vector, y Ξ ( yD, yx, yM )’ with a corresponding price vector p Ξ ( pD,pX,pM )’>0, then it is possible to calculate GDP as their sum:

(1)

(1)

The corresponding calculation from the input-output system for capital and labour incomes delineates a vector of primary inputs (labour and capital) v Ξ ( v1,…,vM )≥ 0 with price vector w Ξ ( w1,…,wM )‘> 0. As with GDP, by summing across the primary inputs an estimate of aggregate income is obtained:

![]() (2)

(2)

The 1993 SNA equates the income and expenditure estimates of GDP (aggregate income) so that by assuming that y and p can be represented by indices, it is possible to write the relationship between nominal GDP and nominal income as:

![]() (3)

(3)

The equality between nominal income and the sum of domestic expenditures plus export less imports means that, in nominal dollars, the estimates of GDP and GDI are equal. To move to GNI and GNDI in open economies, net adjustments for international transfers must be made. If one assumes that the primary factor income transfers and current transfers can be decomposed into price and volume movements, then it is theoretically possible to form commodity ( b Ξ ( b1,…,bB )’) and price ( r Ξ (r1,…,rB )’ >0 ) vectors similar to those for labour and capital. By adjusting nominal income for net income from abroad (NIFA) and net current transfers (NCT), measures of nominal GNI and GNDI can be calculated as:

(4)

(4)

![]() (5)

(5)

2.3.2. Real Income Aggregates

Moving from nominal to real measures of real income involves making two decisions. First, one must decide if the purpose of analysis is related to production or a societies utility curve (i.e. welfare). Second, if one is interested in welfare, it is necessary to decide on a deflator for net measures of income flows captured by the current account of the balance of payments.

If the desire is a real production based measure for examining something like productivity, then deflation should account for all prices so that the resulting real measure is associated with the process of transforming inputs into outputs. This approach yields the commonly used real GDP measure:

(6)

(6)

Measures of real GDP can then be used to calculate measures of productivity that are associated with some progress in the efficiency of production. Productivity growth is typically viewed as the primary source of real income growth in market economies, and a commonly examined measure of productivity is labour productivity that measures real GDP per hour worked:

(7)

(7)

Moving from production-based measures of real income to the utility curve, or welfare, based measures requires the use of an alternative deflator to produce real income estimates measured in terms of what can be purchased with income. Here, a deflator based on final domestic expenditures (FDE) is employed. This choice is espoused by the 1993 SNA because it represents the broadest index of goods and services consumed by domestic agents of an economy.

When the FDE deflator is applied to nominal GDP, the result is real Gross Domestic Income (GDI):

(8)

(8)

Real GDI reflects movements in production and movements in relative prices of traded goods and services. The relative price ratio ![]() is referred to as a trading gain and represents the gain or loss that an open economy receives when relative prices change.

is referred to as a trading gain and represents the gain or loss that an open economy receives when relative prices change.

Using the FDE deflator leads to a difference between the GDP and GDI deflators that comes from their treatment of exports and imports.3 The GDP deflator applies separate export and import deflators which produces an implicit net export deflator. The GDI deflator applies the same price index to imports and exports; in effect it deflates net exports directly.

Reinsdorf (2010) illustrates that using an FDE deflator for net exports leads to a homothetic adjustment of the trading gain across consumption and investment categories. As a result, the trading gain is distributed across expenditures proportional to existing expenditure patterns. Using the FDE deflator also leads to a result where the trading gain is composed of two relative price changes (Kohli 2006). The first is the terms of trade which represents differential movements in export prices and import prices. The second is the relative price of traded to non-traded goods. Of the two, the terms of trade is the more important relative price for real income growth in that its contribution to real income changes is larger than the contribution from is the relative price of traded to non-traded goods (Macdonald 2010). Importantly, the FDE deflator allows for a broader set of relative price changes than other deflator options discussed in the SNA 1993 (Macdonald 2007). In fact, it can be shown that the other deflator options are constrained versions of the FDE based trading gain.

The SNA 1993 measurement of real income applies the FDE deflator to other net income measures in the current account. Because these are income flows without discernable commodities, the SNA 1993 recommends using this broadly based price index. For each of the nominal income aggregates in equations (4) and (5), the final domestic expenditure deflator is used to produce a corresponding real income estimate. Assuming that an additive index is employed, the real income estimates may be written as:

(9)

(9)

(10)

(10)

3. Real Income vs. Real GDP

Real GDP, and measures like labour productivity derived from it, have been used as a metrics for assessing economic performance (see for example Hulten 2001 or Rodgers 2003). However, movements in relative prices and changes in the current account can also have noteworthy effects on economies. This section illustrates several features of the differences between real income estimates and real GDP or labour productivity.

Throughout the discussion, references to real income refer to real Gross National Disposable Income (GNDI). The other measures of real income (real GDI, real GNI) are presented for completeness only. All calculations were made using Tonqvist indexes which are additive in their log-differences. The data used for making current account adjustments were available only in net form making index number disaggregations problematic because the balances can go from positive to negative. Ideally one would examine outflows and inflows separately to understand how differences between the flows affect the balance. The contribution to growth calculations presented below use the difference between real income growth rate estimates to calculate the contribution to growth from a particular real income source. For example, the contribution to growth from the trading gain is calculated as the difference between real GDI and real GDP growth. This is less than ideal as it only illustrates whether net income from abroad added or subtracted to real income growth but does not provide a more insightful understanding of why the balance changed. Nevertheless, for the purposes of demonstrating what can be done with currently collected national accounts data it is sufficient.

3.1. Real Income and Real GDP

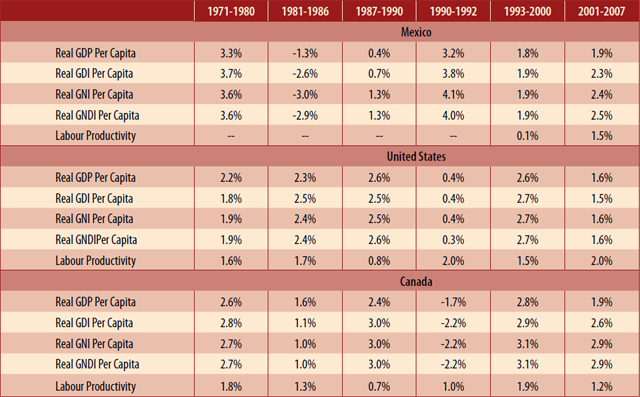

Movements in real income and real GDP can diverge for periods as long as a decade, with real income outpacing or lagging behind real GDP (Table 1). For the North American economies, real GDP and real income tend to move in the same direction because changes in production are the primary source of real income growth. However, changes in relative prices and current account activity can also play important roles in assessing a country’s economic performance.

Table 1

Growth by Real Income Measure vs. Labour Productivity Growth

Growth in Economic Performance Measures

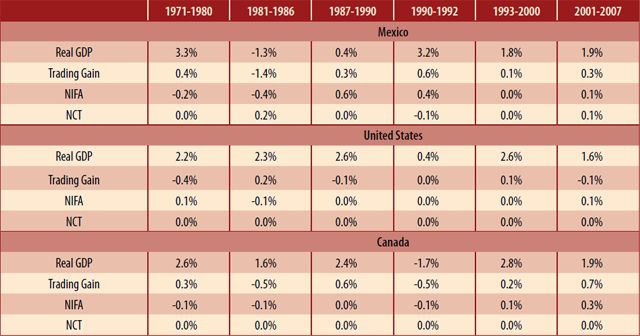

In Mexico, real income grew faster than real GDP from 1971 to 1980. During this period, the trading gain added to real income growth, while net income from abroad (NIFA) detracted from real income growth (Table 2). The peso devaluations and the recession of the early 1980s led to a reduction in real GDP and real income. The average annual growth rate for real GDP was -1.3 percent between 1981 and 1986. The decline in real GNDI was more than twice as large. Currency devaluations in 1982 helped to reduce real income growth through the trading gain by an annual average of 1.4 percentage points per year while NIFA was associated with a further of real income growth by another 0.4 percentage points. Net current transfers (NCT) is the only component of real income that contributed positively to real income growth during this period, adding an annual average of 0.2 percentage points to growth.

Table 2

Contributions to real Gross National Disposable Income Growth

While examining real GNDI makes the downturn of the early 1980s look more pronounced in Mexico than real GDP implies, it also make the subsequent recovery look stronger. Between 1987 and 1990, real GDP progressed at an average annual rate of 0.4 percent. During this period, the trading gain added 0.3 percentage points to average annual growth while NIFA added 0.6 percentage points. As a result, real GNDI income increased at an average annual rate of 1.3 percent versus 0.4 percent for real GDP.

A similar event occurs in Canada in the early 1990s. The 1990-1991 downturn appears deeper, and the recovery stronger, when real income rather than real GDP is examined. This does not mean that real income measures are appropriate for examining business cycles, but rather illustrates that over business cycles movements in relative prices and international income flows can reinforce the business cycle. The result that emerges suggests that the effects of business cycles on domestic agents can be stronger than real GDP implies, and that recoveries can be more pronounced.

Although the transition from real GDP to real GNDI provides additional information about how society’s fare over business cycles, as the Stiglitz-Sen argues, aggregate statistics do not illustrate the experiences of individuals. While the report focussed this criticism on measures of real GDP, it is equally applicable to the real income metrics discussed in the 1993 SNA. Nevertheless, using a purchasing power based measure of real income can illustrate to a larger extent than real GDP the economic circumstances facing domestic agents.

3.2. Real Income and Economic Aggregates

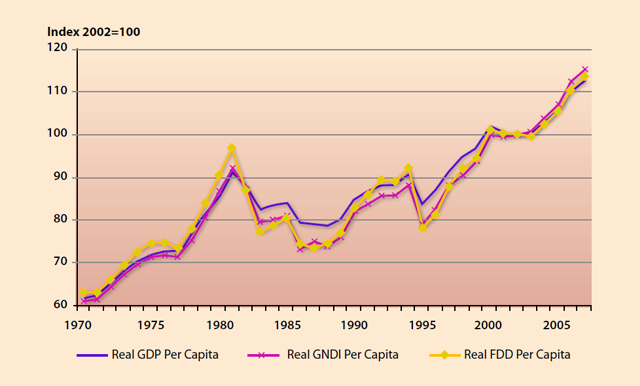

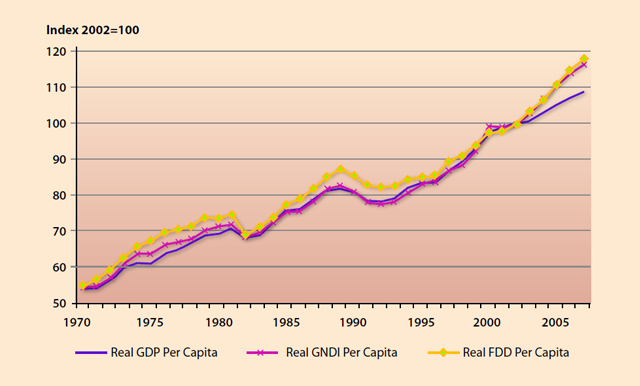

Moving from real GDP to real GNDI improves researchers’ and policy maker’s ability to understand movements in economic aggregates. Charts 3 and 4 illustrate the relationship between real GDP, real GNDI and real Final Domestic Demand (FDD), which is a measure of the volume of purchases made by domestic agents on consumption and investment commodities. In Mexico and Canada, movements in real FDD are more closely associated with movements in real GNDI than with real GDP (Figures 3 and 4).

Chart 3

Mexico – FDD vs. GDP and GNDI

Chart 4

Canada – FDD vs. GDP and GNDI

In Mexico, through the restructuring of the 1980s and the downturn in the mid 1990s, movements in real FDD correlate closely with movements in real GNDI. Real GDP does not change sufficiently to explain why the consumption and investment activity declined as sharply as it did. Nor does the real GDP growth after 1994 have sufficient strength to explain the recovery in real FDD.

In Canada, resource prices are an important source of national real income (Macdonald 2007). In fact, after production (real GDP), terms of trade changes stemming from resource price movements are the most important source of real income growth for Canada. Consequently, during the 1973 and 1979 oil shocks and the most recent period of rising resource prices, real income and real FDD outpace real GDP by a noticeable margin.

Comparing real GDP with other real income measures, and with economic aggregates like real FDD, underscores some of the Stiglitz-Sen report’s desire to look at features of economies that extend beyond production metrics. In Mexico and in Canada, understanding why consumption and investment can progress more rapidly or slowly than GDP, sometimes for up to 5 years at a time, is facilitated by incorporating additional features of the economic system into the analysis.

3.3. Mexico and Canada Relative to the United States

The choice of metric used for international comparisons can have important implications for how a country’s performance is interpreted. This point is explicitly discussed in the Stiglitz-Sen report. Often measures of real GDP Per Capita or labour productivity are used to make international comparisons. These measures reflect movements related to production that may not be ideal for examining the international performance of all nations. For small open economies relative prices and current account activity also play an important role in determining economic performance.

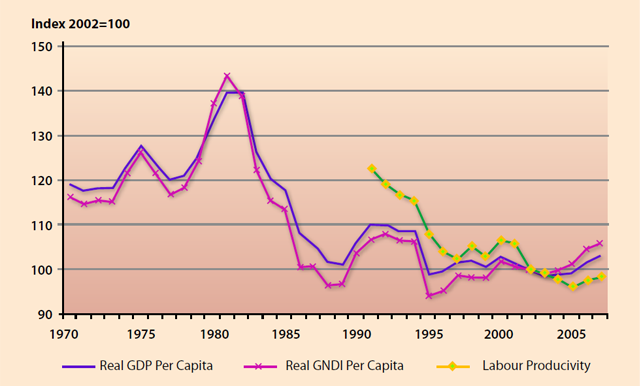

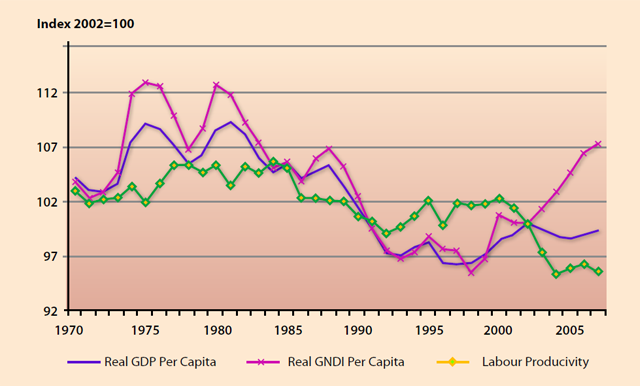

In Mexico and Canada, relative performance is noticeably altered when the focus of comparisons shift to real GNDI Per Capita rather than the commonly used real GDP Per Capita or labour productivity statistics. Charts 5 and 6 plot indexes of labour productivity, real GDP Per Capita and real GNDI Per Capita for Mexico and Canada relative to the US.

Chart 5

Mexico Relative to the US – Real GDP, Labour Productivity and Real GNDI

Chart 6

Canada Relative to the US – Real GDP, Labour Productivity and Real GNDI

In Mexico, real GDP Per Capita and real GNDI Per Capita tend to move similarly from year to year, but over longer periods a divergence can occur. Between 1970 and the early 1980s relative real GNDI Per Capita outpaced relative real GDP Per Capita. The opposite occurred between the early 1980s and the mid 1990s. After 1995, relative real GNDI Per Capita once again outpaced relative real GDP Per Capita. Over the same period, labour productivity declined in Mexico relative to the US. The result that emerges is one where Mexico’s relative productivity does not keep pace with the US, but the purchasing power of the income that accrues to Mexico rises. And, when relative real GNDI Per Capita is examined rather than relative real GDP Per Capita, Mexico appears to have made back all of its lost ground relative to the United States in 1994.

A similar result emerges for Canada relative to the US where movements in real GNDI Per Capita and real GDP Per Capita often move similarly from year to year, but can diverge over longer periods. This type of relationship occurred between the 1970s and late 1990s. After the late 1990s, however, real GNDI Per Capita began increasing in Canada relative to the US. At the same time real GDP Per Capita was fairly level and labour productivity in Canada failed to keep pace with the US.

4. Conclusion

The Stiglitz-Sen report has re-introduced debates about what metrics should be examined and what information should be collected. In doing so, the report has been interpreted by some to call the current measurement system into question. This is unfortunate because some of the features of the economic system that the report advocates are already contained in the System of National Accounts 1993 (SNA 1993).

In this paper, the SNA 1993 recommendations of how to calculate measures of real income were used as an example of the wealth of information that can be extracted from current measurement systems and meet the demands of the Stiglitz-Sen report. The real income measures use real GDP as a starting point and then adjust for relative price effects (primarily from the terms of trade) and non-trade balance entries in the current account of the balance of payments.

When all of the adjustments are made, the resulting real income statistic is referred to as real Gross National Disposable Income (GNDI). Measures of real GNDI can correlate more closely with movements in final domestic demand that does real GDP, and show different paths for performance relative to the US for Canada and Mexico. The results illustrate that, as Stiglitz-Sen argues, more than just production influences welfare.

The Stiglitz-Sen report provides a beneficial step forward in discussions about what should be measured, how it should be measured and what should be the focus of analysis. It does a particularly good job of noting that there is no one-size-fits-all economic metric. This type of discussion is necessary and beneficial. However, it should be noted that current data collection and dissemination systems can provide data of the type espoused by the report. Moreover, their measurement, in theory and in practice, is embedded in the SNA.

![]()

References

Baldwin, J. and Gu, W. (2007). Long-term Productivity Growth in Canada and the United States. Canadian Productivity Review. Statistics Canada Catalogue Number 15-206-XWE2007013.

Corden, W. M. (1960). “The Geometric Representation of Policies to Attain Internal and External Balance”. The Review of Economic Studies. Volume 28(1) Pp. 1-22.

______ (1984). Booming Sector and Dutch Disease Economics: Survey and Consolidation. Oxford Economics Papers. New Series. Volume 36(3). Pp. 359-380.

______ (1992). Dependent Economy Model of the Balance of Payments. New Palgrave Dictionary of Money and Finance. London, MacMillan.

Corden, W. M. and J. P. Neary (1982). “Booming Sector and De-Industrialization in a Small Open Economy”. The Economic Journal. Volume 92(368).Pp. 825-848.

Courbis, R. W. (1969). “Compatabilitié nationale à prix constants et à la productivitié constante”. Review of Income and Wealth. Series 15(1). Pp. 33-76.

Denison, Edward F. (1981). “International Transactions in Measures of the Nation’s Production”. Survey of Current Business. Volume 61(5). Pp. 17-28.

Diewert E. W. (1978). “Superlative Index Numbers and Consistency in Aggregation” . Econométrica 46. Pp. 883-900.

Diewert E. W. and Morrison, C. J. (1986). “Adjusting Output and Productivity Indexes for Changes in the Terms of Trade”. Economic Journal. 96. Pp. 659-679.

Dornbusch, R. (1974). “Real Monetary Aspects of the Effect of Exchange Rate Changes”. In National Monetary Policies and the International Financial System. Ed. R. Z. Aliber, Chicago University Press: Chicago.

______ (1980). Open Economy Macroeconomics. New York: Basic Books Inc.

Fox, K., Kohli, U. and R. Warren. “Accounting for Growth and Output Gaps: Evidence from New Zealand”. The Economic Record. Volume 78 (242). Pp. 312-326.

Francis, Micheal (2007). “The Effect of China on Global Prices”. Bank of Canada Review. Autumn 2007: 13:25.

Gearly, R. C. (1961). “Problems in Deflation of National Accounts: Introduction”. Review of Income and Wealth. Series 9.

Hirsch, Todd (2003). “Updating the Bank of Canada Commodity Price Index”. Bank of Canada Review. Pp. 31-33.

Hulten, C. (2001). “Total Factor Productivity: A Short Biography”. In New Developments in Productivity Analysis. University of Chicago Press.

Kohli, U. (2006a). “Real GDP, Real GDI, and Trading Gains: Canada, 1982-2005”.

International Productivity Monitor. Number 13, Fall 2006. Pp. 46-56.

______ (2006b). Terms of Trade Changes, Real GDP and Real Value Added in the Open Economy: Reassessing Hong Kong’s Growth Performance. Hong Kong Institute for Monetary Research, Working Paper No. 5/2006.

______ (2004). “Real GDP, Real domestic income, and terms of trade changes”. Journal of International Economics. Volume 62. Pp. 83-106.

Kurabayashi, Y. (1971). “The Impact of Terms of Trade on a System of National Accounts: An attempted systhesis”. Review of Income and Wealth. Series 17(3). Pp. 285-297.

Nicholson, J. L. (1960). “The Effects of International Trade on the Measurement of Real National Income”. Economics Journal. 70. Pp. 608-612.

Reinsdorf, M. (2008). Measuring the Effects of Changes in the Terms of Trade on Incomes, Exports and Prices. Presentation to the BEA Advisory Committee, 07 November 2008.

Rodgers, M. (2003). “A Survey of Economic Growth”. Economic Record. Volume 29 (244). Pp. 112-135.

Salter. W. E. G. (1959). “Internal and External Balance: The Role of Price and Expenditure Effects”. Economic Record. Volume 35. Pp. 226-238.

Silver, M. and Mahadavy, K. (1989). “The Measurement of a Nation’s Terms of Trade Effect and Real National Disposable Income Within a National Accounting Framework”. Journal of the Royal Statistical Society. Series A. Vol. 152 (1). Pp. 87-107.

Stuvel, G. (1956). “A New Approach to Measurement of Terms of Trade Effects”. Review of Economic Statistics. August. Pp. 294-307.

System of National Accounts (1993). Commission of the European Communities/ Eurostat, International Monetary Fund, rganisation for Economic Co-operation and Development. United Nations Secretariat, World Bank.

Swan, T. E. (1960). “Economic Control in a Dependent Economy”. Economic Record. 36. Pp. 51-66.

Tornqvist, L. (1936). “The Bank of Finland’s Consumption Price Index”. Bank of Finland Monthly Bulletin. No. 10. Pp. 1-8.

![]()

1 It is possible to have real GDP contract while real GDI rises. This paradoxical possibility was raised by Kohli (2004) in a theoretical discussion. In Canada, production in the province of Manitoba depends importantly on grain farming. In 1988, a drought affected crop harvests leading to lower yields and higher prices. Real GDP in Manitoba contracted 0.5 percent in 1988 while real GDI rose 3.5 percent.

2 GNI was formerly referred to as Gross National Product.

3 In the literature surrounding the System of National Accounts (SNA) the trading gain is derived from deflating net exports directly rather than using an implicit price deflator. The SNA presents several options for deflating net exports, including import prices, export prices, an average of import and export prices or a final domestic expenditure price index. For discussions regarding which method is most satisfactory (see: Geary 1961, Stuvel 1959, Dennison 1981, Silver and Mahdavy 1989, Nicholson 1960, Courbis 1969, Kubayashi 1971, Kohli 2006, SNA 1993).

Currently the Bureau of Economic Analysis in the United States calculates a command basis GDP that is equivalent to the real GDI discussed in the SNA using an import price deflator.