Crime against the private sector in Latin America: existing data and future orientations to analyse the victimization of businesses

Vol.4 Núm.2 Crime against the private sector…

|

This paper answers the following research questions: what are the existing instruments and data for measuring the level and impact of crime against the private sector in Latin America? What can be done to measure this issue more thoroughly across the region? The analysis of the available data shows specific gaps and needs for better measuring crime against business across Latin American countries. In particular, the lack of reliability and consistency of administrative crime statistics, the lack of business victimization surveys both at regional and at national level, and the need for harmonization towards international and European standards are the main issues. The paper also reviews existing studies, at international level, on crime against the private sector, and it concludes by suggesting future orientations to measure this phenomenon more thoroughly in Latin America. |

El objetivo principal del presente artículo es proporcionar la información preliminar necesaria para identificar y evaluar las formas existentes de medición del crimen contra el sector privado en Latinoamérica1 y proponer opciones futuras para medir este fenómeno más cuidadosamente a nivel nacional y local, de conformidad con los estándares europeos. El análisis de la información que existe y de los instrumentos con los cuales se mide el crimen en contra del sector privado en Latinoamérica deja al descubierto algunos huecos y necesidades emergentes; en particular, están la falta de credibilidad y consecuencia de las estadísticas administrativas sobre el crimen al medir dicho fenómeno, la ausencia de encuestas sobre abusos tanto a nivel nacional como local, la necesidad de una encuesta local que cumpla con los estándares europeos e internacionales y, por último, proporcionar resultados comparables sobre los abusos en contra del sector privado en todos los países de Latinoamérica. Palabras clave: crímenes contra negocios, encuestas de abusos, crimen organizado, extorsión, estadísticas del crimen. |

Recibido: 16 de octubre de 2012.

Aceptado: 15 de mayo de 2013.

1. Introducción

Crime against business means those offences affecting a business or individuals because of their employment (Ewart and Tate 2007, p. 36). The victims of these types of crime can be the businesses or their employees, while the perpetrators can be individuals (employees, customers), other businesses (competitors, suppliers), public officials or criminal groups (Broadhurst 2011, p. 19; Sjögren & Skogh 2004).

Businesses are crucial subjects for the social and economic development of societies because they provide jobs and opportunities in a given country. Crime against the private sector hampers business activities by reducing and diverting their resources. It includes several types of offences which could differently affect the ability of companies to do business and to be competitive on the economic market.

Despite this evident problem, a lack of comprehensive quantitative research on crime against business has recently emerged. One of the major pitfalls in studying and analysing this issue relates to the lack of reliable and comparable data to clearly assess its level and features across different countries. This deficiency also influences the possibility of developing efficient and effective measures of prevention within businesses, as well as efficient and effective public policies to counter this issue in different contexts.

The aim of this paper is to contribute to the development of more empirical researches on crime against the private sector across a region: Latin America,2 which still presents a serious gap of knowledge in this field of research.

The research questions central to this paper are: what are the existing instruments and data for measuring the level and impact of crime against the private sector in Latin America? What can be done to measure this issue more thoroughly?

In order to answer these questions, this paper provides a review of the main surveys at international and European level and a discussion on their main results (sections 2 and 3); it then identifies and assesses the available data on crime against the private sector in Latin America, and it concludes by suggesting future orientations to better measure this phenomenon across Latin American countries, taking into consideration European and international standards3 (section 4 and 5).

2. The international panorama on the measurement of crime against the private sector4

The importance of measuring crime against business at international level firstly emerged more than ten years ago.

Given that administrative crime statistics5 do not provide specific measures of crime against the private sector, international and national organizations started to measure this issue through alternative sources of data and, in particular, through victimization surveys.

The measurement of crime against business entered the United Nations’ Agenda in 1994, with the development of the International Crime Commercial Survey (ICCS). On the basis of this first investigation, the International Crime Business Survey (ICBS) and the Crime and Corruption Business Survey (CCBS) were then designed and carried out respectively in 2000 and in 2006/2007. In most recent years (2012), a Crime and Corruption Business Survey has been developed across the seven Western Balkan countries.

With the Action Plan 2006-2010, the European Commission also acknowledged the need of improving data’s quality and coverage for crime and criminal justice areas through the development of indicators for “measuring the extent and structure of victimization in the business sector” (Task 5.14). This need resulted in the pilot EU Business Crime Survey, carried out in 2012 on 20 EU Member States, by Gallup Europe and Transcrime-UCSC.

At national level, the need of studying this issue emerged even before. The first Commercial Crime Survey (CVS) was conducted in the United States, in 1972, at national and city level on an annual basis. It was suspended in 1977 because external reviews found that the sample was undersized (15 000 businesses), and that the survey was of limited utility as it failed to collect information beyond that already gathered by the police (Lynch & Addington, 2007). Another important and large-scale survey on crime against business begun in 1993, in Australia, by the Australian Institute of Criminology (AIC), based on the methodology of the first International Business Crime Survey (ICBS) (Walker 1994). Another survey Crime against Small Businesses in Australia was conducted in 1999 on a large sample of 4 315 small businesses in the retail food, retail liquor, newsagent, pharmacy, and service station sectors (Perrone 2000). Also the first Business Crime Victimization Survey ever conducted in China was based on the questionnaire of the ICBS. It was carried out in 2005-2006 on businesses in four Chinese cities (Hong Kong, Shenzhen, Shanghai and X’ian), by a team of researchers of the Australian National University and the University of Hong Kong (Broadhurst et al. 2011).

The Business Crime Monitor (MCB) in the Netherlands, and the Commercial Victimization Survey (CVS) in England and Wales are the first examples of quantitative investigations on crime against business in Europe (see table 1). The first Dutch survey was developed in 1989 by the Dutch Ministry of Justice (WODC), while the English one in 1994 by the Home Office. These surveys have been then conducted periodically (the last waves were developed respectively in 2010 and 2012), witnessing the strategic importance of the information collected and the need to update them periodically.

Other large-scale surveys in Europe, specifically focused on the victimization of the private sector, have been carried out in Finland (1995, 1997), Bulgaria (1997), Scotland (1998), Estonia (2007), Italy (2008), Cyprus (2009) and Switzerland (2010), under the supervision of different public institutions such as the National Statistical Institutes, the Ministries of Justice or the Ministry of the Interior, or specific research centres within the University.

The table 1 shows that at European and international level the measurement of crime against the private sector relies on the following main investigations:

• Four surveys at international level by public organizations (UNODC/UNICRI): the ICCS (on 12 countries), the ICBS (on nine capital cities), the CCBS (on four countries), the Survey on Security and Crime against Business in the Western Balkans (on the seven Western Balkan countries).

• One survey at European level by the European Commission: EU BCS (on 20 countries).

• 13 large-scale surveys at national level by public organizations (National Statistical Institutes, Ministry of the Interior, Ministry of Justice, Research Centres).

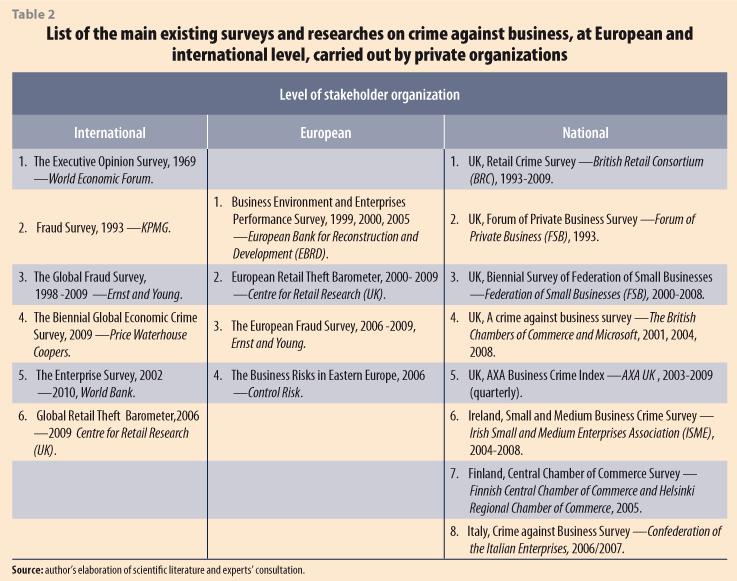

Besides the abovementioned surveys, mainly carried out by public institutions, other surveys at international, national and local level have been developed by private organizations and large private accounting/audit and insurance multi-nationals such as PricewaterhouseCoopers, KPMG, Ernst & Young (see table 2 for further details).

The main purpose of these investigations is usually the development of crime-prevention initiatives, targeted on specific economic sectors and on specific types of crime (fraud in most cases). However, especially in the case of insurance companies, it may happen that these surveys tend to overestimate or underestimate the level of crime against their clients in order to support their interests and/or to avoid damaging their reputation. Therefore, the results of these surveys should be analysed with caution because they could be strongly misleading.

3. Crucial lessons from existing crime against business surveys

On the basis of the results of the main surveys and researches mentioned above, different countries and institutions started analysing the main features of crime against the private sector.

First of all, it was evident that it forms a significant part of all criminal activities. At European level, for example, on average, more than three businesses out of ten have experienced at least one crime in the past 12 months (Gallup & Transcrime 2012).6 In England and Wales almost half (46%) of premises covered by the 2012 Commercial Victimization Survey had experienced at least one type of crime in the 12 months prior to interview (Home Office 2013). In the Netherlands, in 2010, almost a third (31%) of all companies indicated that they had been victim of one or more types of criminality in the past 12 months (WODC 2011). In China, between 2004 and 2005, 26.2% of businesses were victims of common crimes (Broadhurst et al. 2011).

Moreover, the business sector is a prime target for many forms of property crime. In UK, in 2001, seven out of ten thefts of personal properties took place at work (Home Office, 2002). The Business victimization rates for property crimes are also much higher than those for individuals. At European level, annually around 11% of businesses are victims of burglary (Gallup & Transcrime 2012), a percentage which is more than six times higher than the one recorded for households (1.7%)7 (Van Dijk et al. 2007 p. 266). In Italy, between 2007 and 2008, the victimization of businesses was 10 times higher than the victimization of individuals (36% against 3.7%) (Mugellini 2012). Moreover, crime against business forms a significant part of the total economic and social costs of crime; and the losses suffered by businesses as a consequence of crime, as well as the indirect impact on the community, are enormous. A study in 1989 reports that in the US, employee theft accounts for between 5% and 30% of business bankruptcies each year (Dickens et al. 1989, p. 332).

In some countries, specific types of crime against businesses, such as extortion, protection money, intimidation and threats, are often related to the activities of organized crime groups, or to criminal organizations. In Italy, 26% of the businesses victims of at least one incident of intimidation and threats, and 77.5% of the businesses victims of at least one incident of extortion reported that these crimes have been committed by local organized crime groups (Mugellini 2012). In England and Wales around half (47%) of respondents thought that the offence was carried out by a criminal organization. Just over a quarter of respondents thought an organised group of criminals committed the latest incidents of burglary and theft from vehicles (30% and 26% respectively) (Home Office 2012, p. 23).

This data suggests that some offences against the private sector are not simply sporadic events but, on the contrary, the result of crime activities which are organized and recurring. Multi-victimization is, indeed, very frequent among businesses. The Italian Business Crime Survey shows that more than 69% of companies have been victims of more than one incident of crime in the same year (2008). Moreover, on average, each victimized business experienced seven crimes a year; this number is three times higher than the one registered for individuals (around two crimes per year) (Mugellini 2012).

For these reasons, crime against business has also a negative impact on the investment climate. High concentration of crime, and especially organized crime, can limit local and foreign businesses’ investments and therefore hamper the expansion of business communities. In Italy, 14% of micro businesses stated that their investments’ decisions are strongly affected by the risk of being victims of crime (Ibidem). In Eastern Europe, 18% of firms reported that their investments’ decisions are hampered by corruption8 (Alvazzi 2004).

Crime against business leads also to higher costs of doing business, “because of the need for different forms of security measures, because it diverts investment away from business expansion and productivity improvement, and may lead to a less than optimal operating strategy” (National Security Private Sector Organization of Jamaica 2010). In the EU and the CIS, businesses consider crime, and especially theft and corruption, among the most impeding obstacles for doing business (WEF 2010).

Crimes against the private sector are very often not reported to the relevant authorities and, as a consequence, not properly analysed and studied. In particular, according to the EU BCS, 65% of the businesses interviewed across 20 European countries did not report the crimes experienced in the previous 12 months. This percentage is close to 90% when considering bribery and corruption and some specific offences committed by employees (e.g. theft and fraud). Also in England and Wales more than half of the businesses victims of vandalism, fraud, and online crimes, did not report them to the police. In Italy the level of the dark figure is even higher, 69% of businesses did not report the incidents of crime to the police, and in case of extortion the non-reporting rates was around 95% (Mugellini 2012, pp. 40-41). In the Netherlands, the reporting behaviour of companies is more consistent; indeed, in 2010 almost 60% declared to have reported the offence to the police (WODC 2011, p. 296).

This kind of information represents a powerful instrument in the hands of both business managers, who could orientate the economic resources of their firms in order to invest in the most useful and efficient preventive measures, and policy makers, who could develop large-scale interventions in favour of the most vulnerable economic subjects. In the UK, many initiatives, such as the Action Fraud Centre,9 the Financial Fraud Action,10 and the Fraud Advisory Panel11 were developed as a consequence of the high level of frauds detected by the first investigations on crime against the private sector.

At the small-scale level, investigating crime against business can help identifying its patterns and predictors, and the associated risk factors for specific crime problems. It can allow detecting whether some particular feature of the business premises influences the risk of victimization more than others, and thus allows intervening on the specific source of vulnerability. For example, data of the Australian National Survey on Crime Against Business (Walker 1995, p. 9) revealed that manufacturing industries which also do some wholesaling in the premises run half the risk of having a serious crime problem, compared to manufacturing businesses overall. The reason is that wholesaling activities at manufacturing premises extend the working day or increase the number of staff. Both of which factors contributed to improving informal surveillance of the premises. The Swiss Business Crime Survey highlights that crimes against business committed by employees are significantly correlated with the size of the business (micro business are less at risk than larger companies), with the measures of prevention adopted by the firms, but especially with the type of corporate culture adopted by the firm. Indeed, companies adopting a corporate culture based on loyalty and tradition are less at risk for employee offences (Isenring et al. 2013).

At a wider-scale level, analysing the level and features of crime against the private sector allows a further understanding of the interconnections between the structural characteristics of the country where a business operates, such as unemployment, population density, country size, etc., and the incidence of crime against businesses.

Moreover, when compared across societies, data on the level and impact of crime against business and on the characteristics of the businesses more victimized could provide important insights into the causal factors of crime and an indication of what the most vulnerable businesses are in different societies. This information may be also linked to a more general framework of economic, social and geographical information, which allows it to be interpreted more effectively and consequently to be able to tackle crime more efficiently.

If we also consider that, as a result of globalization and the use of Internet, many forms of crime are becoming more and more international, this fact is a further good reason for measuring and comparing crime against the private sector across countries.

4. The measurement of crime against business in Latin America

The review and discussion provided above clarifies the actual situation and the main arguments on the international and European panorama.

This section focuses on the situation across Latin American countries related to the measurement of crime against the private sector.

4.1. Pitfalls of administrative crime statistics in measuring the victimization of the private sector in Latin America

Administrative crime statistics do not help a great deal in the measurement of crime against the private sector. Indeed, in many countries they “provide no marker of the extent of crime affecting businesses” (Burrows & Hopkins 2005). Offence categories used within administrative crime statistics are often a poor guide to distinguish when a crime has been committed on business premises or on individuals (Wagstaff et al. 2006, pp. 4-5). In England and Wales as well as in Italy, for example, only two offence categories by definition are made up of crimes involving businesses; respectively theft from shops and robbery of business property; theft and robbery from commercial premises. “Arguably, the extent and nature of business crime has gone unrecognised precisely because the available data and recording mechanisms have been typically inadequate” (Ibidem).

The following chapters analyse the three main failures of administrative statistics in measuring crime against businesses, focusing on the Latin American context.

4.1.1. Lack of a crime classification to identify crime against business.

Within administrative statistics, it is not easy and often not even possible to separate crime against business from other crimes committed against individuals and households.

Looking at the administrative statistics of Latin American countries collected by the Organization of American States (OAS), it emerges that there are no specific categories related to crimes against the private sector.12

According to Guerrero (2012, p. 52) there is a lack of possible indicators for crime against business also when looking at each national administrative crime data collection and, even when available, these indicators poorly represent the actual level of crime against the private sector. Official crime statistics’ classification in Honduras includes theft against gas stations (robo a gasolineras) and armed robbery against firms and shops (robo a mano armada a empresas y negocios) (Posas 2008, p. 8), but these are the only types of crime which could not consistently represent the complex phenomenon of crime against the private sector.

The lack of a statistical classification to measure the victimization of the private sector is a problem for the majority of countries across the world. Only in the US the Uniform Crime Reporting System (UCR), provides data on commercial and non-individual victims.

This problem could also be connected to the fact that there is a general lack of legal frameworks which define crime against the private sector as well as the public institutions responsible for countering it.

The results of the analysis of the Latin American Index for the Evaluation of the Legal Framework on Crime Against the Private Sector (Índice Latinoamericano de Evaluación a Normas sobre Delitos al Sector Privado —ILAND), demonstrates the weakness of the legal frameworks in preventing and contrasting crime against the private sector across Latin American countries (Guerrero 2012, p. 31). One of the main problems seems to be the generic classification and definitions of the types of crime characterizing this phenomenon (Ibidem, p. 34). This problem at legal level inevitably reflects on the organization of administrative statistics on crime which are based on the legal system and on the legal classification of crime.

4.1.2. The “dark number”

Besides the problem related to the lack of a crime classification to identify crime against businesses through administrative statistics, these data collections present many other deficiencies in measuring the real level of crime in a given society. The “dark number” is the most evident one.

The “dark number” obscures a high percentage of the actual volume of crime and it depends on many factors (Grünhut 1951, p. 150): the type of crime and criminals, the strength and efficiency of the police, the changing attitude of the public with respect to crime and the likelihood of reporting suspected crimes and alleged offenders, the changing methods of recording complaints made to the police.

Non-reporting by citizens and not-recording by the Criminal Justice System are also big issues in Latin America. Gaviria and Pages (1999, p. 3) highlight that “Official statistics on crime incidence in Latin America are often incomplete and suffer from serious problems of under-reporting”.

Figure 1 illustrates the percentages of crimes reported to the police by victims as collected by national victimization surveys on individuals in six different Latin American countries.

According to the victims of crime, on average 77% of suffered crime is not reported to the police. In some countries, such as Mexico, this percentage is more than 90%.

The depth of the problem of non-reporting to the police in Latin America clearly emerges in comparison to the European and the United States’ level of non-reporting (50% and 49% respectively).

With regard to the private sector, the recent Encuesta Nacional de Victimización de Empresas (ENVE) carried out in Mexico in 2012 (INEGI) demonstrated that the non-reporting rates for businesses are also very high, around 88 per cent. In Europe, the percentage of firms not reporting the offences to the police is lower, around 65% (Gallup & Transcrime 2012).

Non-conventional crimes, such as bribery, corruption and extortion, are even less reported to the police forces. In Europe, only 7.5% reported the incidents of bribery and corruption to the police (Gallup & Transcrime 2012), while according to the results of the Italian business victimization survey, only 6.6% of businesses victims of extortion and 1.4% of victims of corruption had reported it to the police (Mugellini 2012, p. 1). This is mainly due to the fact that these crimes often imply the direct involvement of the victim (bribery-corruption), or that the victims can fear reprisals from the offenders (extortion). For this reason, with regard to non-conventional crimes the number of recorded offences is rarely a reliable indicator of the actual situation.

This issue thus highlights the need for an alternative measure of these categories of crime across the region, such as victimization surveys on businesses.

4.1.3. Lack of cross-country comparability

When trying to compare administrative crime statistics across different countries, other issues related to three main types of factors should be taken into consideration: substantive, legal and statistical factors. They influence national crime statistics and make more difficult a cross-national comparison.

Substantive factors depend on the likelihood of citizens to report offences to the police, on the propensity of police to record the reported crimes, and on the actual level of crime in different countries. Legal factors refer to the different ways in which crime is defined in each country and to the characteristics of a country’s legal procedures. Statistical factors refer to different methods in which statistics are elaborated; to the statistical counting rules used to collect crime data.

These factors are even more problematic in countries such as Brazil and Mexico, where each independent state has its own penal code and its own statistical counting rules.

Administrative crime statistics in Latin America present many deficiencies from the point of view of the comparability at regional and international level.

Evident problems of comparability emerge when looking at the results of the last United Nations Crime Trends Survey (UN-CTS, 201013). In this case the data collection uses a standard definition of crime and asks different countries to provide data compliant with this definition or to report any deviations from it.

However, for most types of crime reported by Latin American countries, data present many interruptions in the trend and the wide statistical change between one year and the others suggests a lack of reliability and consistency of this data for cross-country comparisons.14

The fact that in some countries (e.g. Brazil, Chile, Ecuador, Guyana) the data for the UN CTS on Intentional Homicide have also been provided by NGO or Health organizations (such as the Pan American Health Organization-PAHO) and not by the Criminal Justice System, indicates a general lack of reliability and confidence in the crime statistics collected by the Criminal Justice System.

This analysis of the existing administrative crime measures at national and regional level, which could be used to measure the victimization of the private sector in Latin America, demonstrates that administrative statistics do not provide reliable and exhaustive measures of crime in general and of crime against the private sector in particular.

Another relevant problem to be highlighted relates to the fact that official-crime statistics have been developed for administrative purposes and not for research interests (Aromaa & Joutsen 2003, pp. 3-6). Therefore, this data can be considered more as social constructs than as a statistical picture of the actual situation of crime in a specific country.

Young (2004, p. 18) hypothesized, for example, that countries with low levels of actual violence “may well have low levels of tolerance with violence and thus report acts which other, more tolerant/violent nations, might ignore”. These different attitudes with respect to crime may result in different levels of recorded crime data.

This could be the case in Latin America, where the use of violence is very frequent during the perpetration of many types of crime, especially when related to criminal groups (Kliksberg 2006, pp. 4-6; Guerrero 2012, p. 24).

Administrative crime statistics are also strongly influenced by politics. Indeed, many countries could be likely to manipulate crime figures to show improvement in their handing of crime issues to the international community.

Bentham defines crime statistics as “a kind of political barometer by which the effect of every legislative operation relative to the subject may be indicated and made palpable” (Wrigley, 1972, p. 428). The problem, according to Lodge, is that “the calibrations of this barometer are not always perfectly clear” (Grünhut, 1951, p. 159) and may be manipulated by politics.

The confidence in the police and in the public authorities is another factor strongly influencing the likelihood of reporting crime to the police. In Latin America there is little confidence in the police professionalism, sometimes due to perceived high levels of collusion between authorities and criminals.

The need for an alternative source of information on this phenomenon is, therefore, not only evident but compelling also in this region.

4.2. Business victimization surveys in Latin America: what has been done so far to measure crime against the private sector listening to the victims’ voice?

Surveying the victims of crime is an important additional source of information on the crime situation of a specific country. Indeed, victimization-surveys help overcoming some of the major problems related to administrative crime statistics and allow to collect data on offences not reported to the police (especially non-conventional crimes) and its several facets. They also provide relevant information on the victims of crime, on the development of the crime incident and, therefore, on the modus operandi of the offenders. Moreover, victimization-surveys enhance the comparability of crime data across countries using standard questionnaires and methodologies.

However, in spite of their numerous advantages, most countries have failed to make systematic use of these research instruments. Indeed, it still has a hard time to gain recognition as one of the central and necessary criminal policy information sources. One of the main reasons refers to the fact that developing victimization-surveys requires an extra budget and a specialized production body which needs to be created in a routine basis. Furthermore, in order to make the best out of victimization surveys, special skills and training are needed and the latter is usually not yet available (Aromaa 2012, pp. 85-94). Moreover, several methodological problems can affect the reliability of the data collected through victimization-surveys if they are not properly designed and analysed.

Identifying the existing surveys on crime against business in Latin America helps in understanding what is the level of diffusion of these instruments and assessing the availability and quality of the data collected across the region.

A preliminary literature review on the existing researches and surveys shows a prevalence of researches carried out by large private organizations such as the World Bank, the World Economic Forum and large private accounting/audit and insurance multi-nationals, such as KPMG, PricewaterhouseCoopers and Ernst and Young but also national Chambers of Commerce.

The table 3 gives a preliminary classification of the existing researches and surveys across Latin American countries divided according to the sector and the level of the stakeholder organization (national, regional, international).

The survey on the Institutional Obstacles for doing business, included in the World Bank “World Development Report 1997” is probably one of the first attempts to measure the burning impact of crime and corruption on the private sector in some Latin American countries. The survey covered Bolivia, Colombia, Costa Rica, Ecuador, Jamaica, Mexico, Paraguay, Peru and Venezuela, showing how corruption, crime and theft were perceived by business managers as main obstacles for the development of firms in these countries (World Bank, 1997, p. 51).

Besides this research in 1997, the World Bank has been covering Latin American countries and the Caribbean for different studies aiming at estimating the economic costs of crime against the private sector within wider projects such as the Country Economic Memoranda (CEM) or the Development Policy Review (DPR). In Jamaica for example, in 2002, a Business Victimization Survey, based on the International Commercial Crime Survey (ICCS), was carried out as a part of the 2003 World Bank Country Economic Memo (CEM) (National Security Private Sector Organization of Jamaica, 2010, p. 6).

The World Bank is also responsible for the conduction of the Enterprise Survey (Amin 2009). The last wave was carried out in 2010 on 14 Latin American countries. Even if it is not exactly focused on the measurement of the level and the characteristics of crime against the private sector, but on the local investment climate and on the obstacles affecting the productivity and growth of businesses, it gives important hints on the gravity of the problem in Latin America. Indeed, according to its results, in 2008, one third of the firms surveyed experienced one or more incident of crime and the crime-related losses represented on average 2.7% of annual sales.

Moreover, it showed that in Latin America and the Caribbean 34.3% of businesses interviewed perceived crime, theft and disorder as major constrains for their activities.15

The Ernst and Young Global Fraud Survey covers only Brazil and Mexico; the Global Retail Theft Barometer, developed by the Centre for Retail Research, focuses on Argentina, Brazil and Mexico, while the regional survey Corporate Fraud in Latin America conducted by KPMG covers Argentina, Brazil, Chile, Mexico, Uruguay.

It is, therefore, evident the general lack of updated and comprehensive researches on crime against the private sector carried out at regional level in Latin America.

The situation is even worse when looking it at national level: only two surveys on the victimization of the private sector, both developed by National Chambers of Commerce, have been registered, respectively in Chile and in Uruguay.

In Chile, the “Encuesta de Victimización del Comercio” has been carried out twice (2008-2009/2010-2011), on around 600 business premises, by the Cámara Nacional de Comercio in cooperation with Adimark (leader in market and public opinion surveys in Chile). The data are collected by semester and cover nine different types of crime (Cámara Nacional de Comercio-ADIMARK 2011; Carrier 2011).

The Encuesta de Victimización-Comisión de Seguridad Ciudadana has been carried out in Uruguay in 2009 by the Cámara Nacional de Comercio y Servicios del Uruguay and covers eight different types of crime against businesses.

It seems that the problem of the victimization of the private sector was not among the main issues of the public agendas of Latin American countries, as far as only the National Institute of Statistics and Geography (INEGI) in Mexico developed the first large-scale survey on the victimization of the private sector in 2012. The Encuesta Nacional de Victimización de Empresas (ENVE) clearly demonstrated how widespread and costly is crime against the private sector in Mexico. In 2011, 37.4% business premises in Mexico have been victims of at least on crime. On average, each firm has experienced 3.1 offences across 12 months. The total cost as a consequence of insecurity and crime across all the business premises is around 115 billion pesos (0.75% of the GDP); on average 56 774 pesos per business.

Moreover, the results of this survey highlight how wide is the dark number in relation to crime against the private sector. Indeed, 88% of businesses victims of crime did not report it to the relevant authorities.

The results of the few existing surveys on crime against the private sector across Latin American countries further demonstrate the need and the importance of measuring and analysing this issue more thoroughly.

4.2.1. Types of crime covered by existing surveys in Latin America

This section analyses the types of crime covered by the existing surveys in Latin America, focusing in particular on the ones carried at national level which seem to be the more complete considering the types of crime covered. Indeed, the other surveys focus only on a specific or on few categories of crime (e.g. fraud or theft).

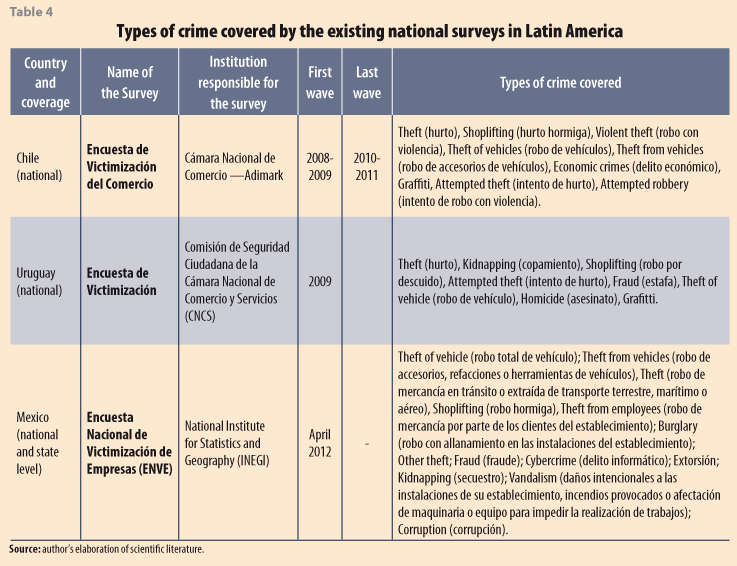

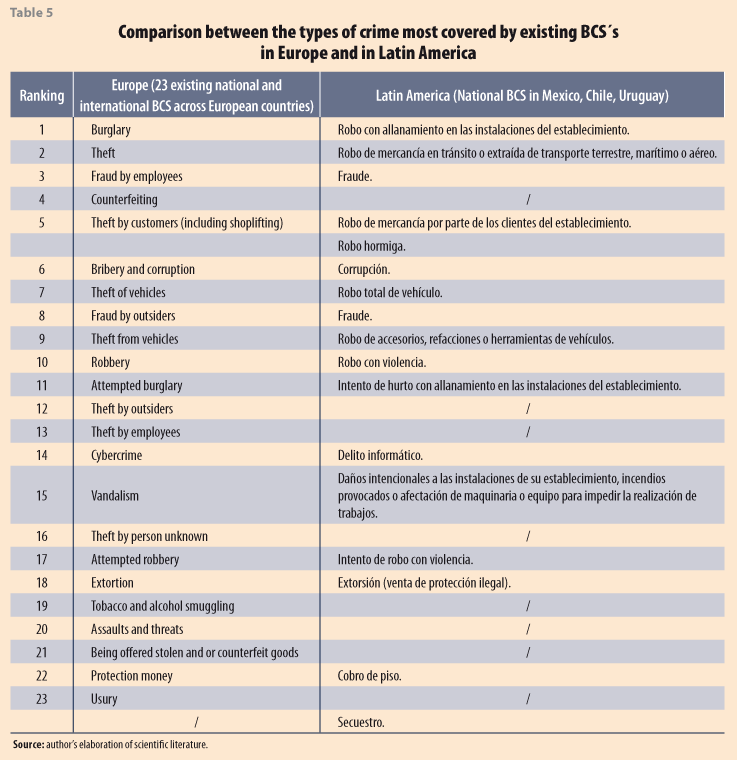

Table 4 identifies the types of crime covered by the four existing national surveys on the victimization of the private sector in Latin America.

The types of crime more frequently covered by existing surveys in Latin America are those related to theft, fraud and kidnapping.

Comparing the specific offences included within the existing business victimization surveys in Latin America with those covered by European and international researches, some deficiencies emerged, as shown in table 5. In particular, existing Latin American surveys do not include counterfeiting, assaults and threats and the distinction between fraud and theft committed by employees and by outsiders.

Moreover, some hints emerge also when analysing and comparing the operational definitions of these crimes to international and European standards.

In particular, from the definition of robo hormiga (very frequent theft of small objects within a business premise, which is usually a shop) it is not clear whether this crime is committed only by employees, only by customers or by both of them. At EU and International level the category of shoplifting implies the commission of the event by customers, and it does not represent a stand-alone category of crime but it is often included within “Theft from premises by customers”.16

The offence robo de mercancía en tránsito o extraída de transporte terrestre, marítimo o aéreo is a very specific category of crime indicating not only its target (mercancía) but also the “situation” where it develops (en tránsito o extraída de transporte terrestre, marítimo o aéreo). At European and international level this category does not exist as it is included within “Theft from vehicles”. Therefore, in order to avoid double counting of crimes it is fundamental to clearly specify the operational definition of this crime event and choose mutually exclusive categories.

It is worthy to focus also on another category of theft included in existing Latin American surveys: robo con allanamiento en las instalaciones del establecimiento. According to the definition provided by the Organization of America States (OAS) robo con allanamiento could be identified with burglary and defined as: “gaining unauthorised access to a part of a building/dwelling or other premises, including by use of force, with the intent to steal goods (breaking and entering)”.17 It is strategic for businesses to collect information on this particular category of theft because it implies very specific modus operandi by the criminals and because it could be prevented by using ad hoc security measures. Existing BCS at European and international level consider this category of theft18 highlighting the distinguishing features of burglary: traces of illegal entry and the absence of interaction with anyone within the premises. Indeed, in the case of interaction, and use of force, between the offender/s and somebody within the business premises the event should be classified as robbery (robo con violencia).

According to the OAS, robo con violencia or robbery could be defined as “the theft of property from a person, overcoming resistance by force or threat of force”. According to European and international standards for business surveys, robbery/attempted robbery is defined as “anyone not employed attempting and/or stealing something from the business’s local unit or from any of the employees (during their work at the business’s local unit’s premises) by using force or threats of force. This includes robbery of personal property as well as money/goods belonging to the business’s local unit, provided employees were on duty at the time. It does not include robbery of personal property from non-employees”. The definition of this type of crime is very important as well as controversial. Indeed, in many countries, “robbery” is not a specific type of theft, but a specific type of crime against property with interaction between the victim/s and the offender/s. The English language, as well as the Italian one, defines it through specific words, respectively “robbery” (in Italian is rapina), which highlight its difference from “theft” (in Italian is furto). Looking at the OAS definitions of crimes it seems that also the Spanish language distinguishes between robo and hurto. The operational definitions of these two different categories of offence should be better developed and clarified because the distinction between the two phenomena is fundamental when collecting data on crime.

In relation to fraude, what is lacking within the existing surveys in Latin America, in comparison to European and international standards, is a clear distinction between fraud committed by employees19 and fraud committed by outsiders20 (such as customers, distributors or suppliers). These two categories are very different in terms of modus operandi of the offenders and, as a consequence, in terms of security measures to prevent and counter crime. Therefore, it would be of fundamental importance to collect separate information on both these categories.

Extortion is another type of crime not easily defined. Indeed, extorsión (venta de protección ilegal) could consist in the request of money or any other benefits from the businesses by using force or by threatening managers and/or employees; or it could consist in the request of money or any other benefits in exchange for “informal” services of protection against crimes committed also by criminal groups different from the one offering the “service” (cobro de piso).

According to Guerrero (2012, p. 3), extortion is one of the crimes having the highest economic impact on the business community in Latin America. Besides the direct costs paid by the companies to “purchase” protection services, or to avoid being victims of a crime, it also causes indirect costs by impeding the development of the criminal-justice system and discouraging business investments and competition. The criminals substitute to the public institutions in the protection of the business community.

It is of fundamental importance, especially across Latin American countries, to distinguish the different types of extortion because they are usually explanatory of the seriousness of crime, and could also provide information on the offenders. The most frequent types of extortion included within the Mexican survey on crime against business (ENVE) are: extortion by phone (this is usually carried out by unknown criminals who pose themselves as members of some well-known criminal organization in order to exploit its reputation and extort money from the businesses), through Internet/email, in the street, within the businesses premises, for protection money (cobro de piso). As far as in Latin America this crime is not only committed by criminal organization (mafias), but also by paramilitary groups and juvenile gangs, it would be important to ask information about the authors of the event in order to understand its characteristics.

Corrupción y cohecho is also a type of crime extremely frequent and costly for the business community and for the entire society, as it causes a mistrust in public institutions and impedes market economy. The operational definition of this type of crime is very controversial because it could refer to different types of behaviour which may be criminalized in some countries but not in others. Its active and/or passive development is very important to be distinguished. It is active when the payment of the bribe is done by the business to public officials, politicians or other private subjects, in order to obtain specific advantages or simply to obtain required licenses or permits or the non-application of sanctions. It is passive when the “payment” is offered to the business in order to obtain a specific service.

According to the previous analyses on the types of crime included within the existing business victimization surveys, there is one offence which is included only within Latin American surveys: kidnapping (secuestro). Kidnapping is probably the most characteristic type of crime against businesses operating in Latin American countries. It is not included in any other existing surveys at European or international level, because it is not a concern for businesses in Europe, or at least not anymore. However, in Latin America kidnapping of managers, or entrepreneurs, or even employees of a specific business is a main concern for the business community, especially in countries such as Peru, Bolivia, Nicaragua, Mexico and Colombia where more than one kidnapping every 100 000 population is registered every year (Guerrero 2012, pp. 5-7).

Usually this type of crime targets businesses with high incomes, in order for the criminals to be sure to get a consistent ransom. However, it has also been recently developed a specific type of kidnapping, defined secuestro exprés, carried out by non-professional criminals and targeting a wider range of businesses and individuals (Guerrero 2012, p. 7). Usually, this specific type of kidnapping does not imply a request for ransom but the person kidnapped is obliged to withdraw money from a cashpoint or provide jewels or other goods to the criminals.

As far as secuestro exprés presents completely different characteristics with respect to the “classic” forms of kidnapping, both in terms of modus operandi of the criminals and in terms of costs for the business, it would be important to ask businesses interviewed to specify the types of kidnapping they were victims of.

Generally speaking, when defining the different types of crime it is fundamental to highlight the structural elements of the crime considered, such as the characteristics of the offender, his/her modus operandi, the target of the offence and the place in which the offence is perpetrated.

4.2.2. Data collection methods and type of businesses covered by existing surveys in Latin

America

This chapter shows the methodological components of the existing surveys on the victimization of the private sector in Latin America and addresses the most important European and international methodological standards to carry out this kind of surveys.

Table 6 illustrates the information collected from the relevant scientific literature on existing surveys and researchers in Latin America.

According to the table above, the existing surveys in Latin America have been carried out through Computer Assisted Telephone Interviews (CATI) and through face-to-face interviews. In Chile, the economic sectors covered are: “wholesale and retail trade; repair of motor vehicles and motorcycles”, “hotels and restaurants” and the third sector, while the Mexican survey covered the entire economic sector with the exception of agriculture and agricultural related services.

Even if it was not possible to collect more detailed information on the methodological characteristics of the existing surveys in Latin America, with the exception of the Mexican one (ENVE), on the basis of the European and international methodological standards, it is possible to address the main methodological components which should be considered when developing victimization survey on crime against business.

The first issue to be taken into consideration is the target population of the survey, which represents the complete set of units to be studied. It defines the coverage of a particular survey and it should be defined according to the identified goals and objective of the survey. With regard to crime victimization, the target population is the set of units that could be victims of the types of crime under investigation (UNECE, UNODC 2009, p. 38).

Usually, business surveys may select their target population depending on the economic sector, size of the company, and its geographical location. This decision depends on several considerations; the most important ones being the objective of the survey, the availability of suitable sampling frames,21 the economic resources available to carry out the survey, and the types of crime the survey intends to address. “Wholesale and retail trade; repair of motor vehicles and motorcycles” is the economic sector22 covered by the majority of the existing surveys carried out at both national and international level (see section 2), followed by “manufacturing” and “hotels and restaurants”.

These three economic sectors are those more in need of investigation with regard to crime against business. “Construction”, “transportation and storage, information and communication” and the “financial sector” also show a high coverage among the considered surveys.

With regard to the size of the business to be included within the target population, existing surveys tended to focus, with some exceptions, on enterprises of all sizes: micro (1-9 persons employed), small (10–49 persons employed), medium (50 –249 persons employed) and large (250 persons and over employed).

Once the characteristics of the target population are identified (economic sectors and size of the businesses), the sample units should be selected.

The sample unit is the target of the survey. Samples used for victimization surveys on businesses are composed of “individual business premises” or of “head offices”. An individual business premises is defined as the actual premises at which the respondent is located, the physical place in which a legal and economic unit (company, institution) exercises one or more economic activities.

Head offices are larger businesses operating through business premises. The “individual business premises” is usually preferred because it allows the inclusion in the same sample of more than one branch of the same company, and especially because it is usually difficult, in the case of “head offices survey”, to find a person able to answer questions about incidents of crime occurring in the whole company (UNECE, UNODC 2009). Interviewing “head offices” could, however, lead to obtaining more specific information, for example, about the costs the business incurs for crime and the amount they spend on prevention.

However, the choice of the sample unit is strictly dependent on the information available within the sampling frame, the list of business units from which the sample should be extracted. In some countries, information on the economic sector of activity, size and other characteristics of the business are not available for the single business establishment but only for the head office.

Together with the sample unit the sample size too is fundamental when developing a victimization survey seeking to collect comparable information across different provinces, countries or regions. Victimization of individuals is a relatively rare event and only a percentage of the sample units will have been victims of specific offences during the survey’s reference period. For this reason, victimization sample sizes should be quite large to achieve the survey’s goals. However, victimization of businesses is a less rare event: for some types of crime the rate of victimization for businesses is 50% higher than the victimization of individuals.

Sample size should be selected primarily according to the desired precision of the survey estimates and also according to the type of data collection method chosen for the interviews.

Indeed, the way in which the sample units are interviewed (the data collection method) can have an incisive impact on the surveys’ data reliability and comparability. The main data capture methods employed for victimization surveys are face-to-face interviews (or “in person” interviews); telephone interviews, self-administered interviews23 and internet based questionnaires. Each of them has advantages and disadvantages in terms of the identification of respondents, response rates, the relationship between interviewer and respondents, costs in terms of time and money, anonymity and respect for privacy. Among existing victimization surveys targeting individuals the most common survey method is face-to-face interviews, followed by telephone interviews. A combination of survey methods is often used. For example, the European Business Crime Survey uses a combination of telephone interviews, for the screening section of the questionnaire, and Computer Assisted Web Interviews (CAWI), only for those businesses which declared to have been victims of crime.

In Mexico, researchers from INEGI, highlighted that nowadays the best method to collect reliable and consistent data from victims of crime in their country is still the face-to-face interview. Even if they are aware about the high costs of this methodology, they pointed out that the internet diffusion is still too low for developing a web-survey and also that other methods would not allow collecting representative information on this crime phenomenon. Indeed, businesses do not trust disclosing sensitive information, such as their turnover or crime suffered, on the phone, especially because some types of crime are carried out by phone, such as extortion.

5. Discussion and conclusions: emerging gaps and future orientations for measuring the victimization of the private sector in Latin America

The analysis of the existing instruments to measure the victimization of the private sector in Latin America and their comparison with European and international standards, allows the identification of some emerging gaps and pitfalls.

First of all, Latin American countries, as well as the majority of countries across the world, could not rely on administrative crime statistics to measure the victimization of the private sector because of three main reasons: the lack of a crime classification to identify crime against business, the high level of the dark number and the lack of cross-country comparability of these statistics. The need for alternative measures of crime against business, and in particular, for victimization surveys is therefore more and more evident and urgent.

However, the review of the scientific literature reveals a general lack of these data collection instruments across Latin American countries. The existing investigations across this region are mainly focused on the obstacles for doing business rather than on the crimes affecting businesses. At national level only Chile and Uruguay carried out victimization surveys on the private sector through their national Chambers of Commerce, and only the National Institute for Statistics and Geography (INEGI) in Mexico in 2012 developed a large-scale investigation specifically focused on crime against business. The comparison between these surveys and those existing at European and international level highlights some pitfalls and allows providing some suggestions for a further development of these instruments in Latin America (see section 4).

In particular, the gaps analysed above in relation to the measurement of the victimization of the private sector in Latin America suggests the need for the development of a regional survey ensuring the coverage of specific types of crime and the harmonization towards international standards.

This kind of survey would represent the first set of comparable indicators to analyse the victimization of the private sector across Latin American countries.

Even if, in some cases, the results of victimization surveys, especially of those conducted by institutions in the private sector, have been exploited to justify the presence of specific services (e.g. insurances or consulting firms); in many occasions (as demonstrated in session 2) they are fundamental to launch specific counter-crime programmes and to make the public opinion, as well as policy makers, aware of the negative impact of crime against the private sector, not only for the business community but for the whole economy of countries.

The importance of collecting and analysing data on crime against the private sector which can be compared at regional level, and which are also comparable with international and European standards, consists in the possibility to look at national crime problems by putting them in an international perspective and borrow solutions for crime from other countries (Howard, et al. 2000; Lynch 1995; Van Dijk et al.1990).

Indeed, one of the chief efforts of comparative research into crime consists in identifying the extent to which structures and cultures at national level affect the degree, types, distributions, and characteristics of crime and crime control, within and across countries. There could thus be an interpretation of national crime trends and processes taking into consideration not only the intra-national, but also the cross-national cultural, social and economic settings. This means providing the national authorities and decision makers with relevant data to broaden their decisions criteria and to increase their ability to assess the impact of public policies upon society at large.

![]()

References

Amin, M., 2009. Crime, ‘Security and Firms in Latin America’, World Bank Group (edited by) Enterprise Note N. 2.

Alvazzi Del Frate, A., 2004. ‘The International Crime Business Survey: Findings From Nine-Central Eastern European Cities’, European Journal On Criminal Policy And Research. No. 10, pp. 137-161.

Aromaa, K. and Joutsen, M., 2003. ‘Introduction’, HEUNI Crime and Criminal Justice in Europe and North America 1995-1997: Report on the Sixth United Nations Survey on Crime Trends and Criminal Justice Systems. Helsinki.

Aromaa, K., 2012. ‘Victimization survey-what are they good for?’, TEMIDA, page 85-94, June 2012.

Banco Interamericano de Desarrollo, 2002. La violencia en Honduras y la Region Del Valle De Sula.

Broadhurst, R., Bacon-Shone, J., Bouhours, B., Bouhours, T., 2011. Business and the risk of crime in China. Asian Studies Series Monograph 3, Australian University Press 2011.

Burrows, J. and Hopkins, M., 2005. ‘Business and Crime’, in Tilley, N. (Ed.), Handbook of Crime Prevention and Community Safety. Willan Publishing, pp. 486-516.

Cámara Nacional de Comercio de Chile-ADIMARK, 2011. Victimización del Comercio. Quinta edición, Proyecto Núm. 1703/2007.

Carrier, A., 2011. `Seguridad privada y comercio. Medidas de seguridad privada, percepción de riesgo e inseguridad: evolución y efectos en Santiago 2000-2009´, Serie Documentos de análisis Núm. 18, Observatorio Regional de Paz y Seguridad, Universidad Bernardo O´Higgings.

Centre for Retail Research, 2010. The Global Retail Theft Barometer 2010. Monitoring the Costs of Shrinkage and Crime in the Global Retail Industry The Worldwide Shrinkage Survey.

Dickens, W. T., Lawrence, F. K., Lang K., & Summers, L.H., 1989. Employee crime and the monitoring puzzle. Journal of Labor Economics. Vol. 7(3): 331-347.

Ewart, B. W. and Tate, A., 2007 ‘Policing Retail Crime: From Minor Offending To Organised Criminal Networks’, Criminology Research Focus. Pp. 33-67.

Gallup & Transcrime, 2012. “EU Survey to Assess the Level and Impact of Crimes against Business: A Pilot Study–PART II”. Presentation at the conference of the American Society of Criminology, Chicago, November 2012.

Gaviria, A. and Pagés, C., 1999. `Patterns of Crime Victimization in Latin America´, Working Paper n. 408, Inter-American Development —Bank Banco Interamericano de Desarrollo (BID)—, Office of the Chief Economist —Oficina del Economista Jefe—.

Grünhut, M., 1951. `Statistics in Criminology´, in Journal of the Royal Statistical Society. Vol CXIV, Parte II.

Guerrero Gutiérrez, E., 2012 (Forthcoming), `Evaluación de los desafíos en materia de victimización del sector privado en América Latina (análisis cualitativo)’, UNODC publication.

Home Office, 2013. Crime against businesses: Headline findings from the 2012 Commercial Victimization Survey. Home Office Statistics 2013.

Isenring, G. L., Mugellini, G., Killias, M., 2013 (Forthcoming), Survey to assess the level and impact of crimes against businesses in Switzerland. Swiss National Science Foundation and University of Zurich.

Kliksberg, B., 2006. Myths and Reality Regarding Criminality in Latin America. Strategic notes on how to confront it and improve social cohesion, National Institute of Public Administration.

Lynch, J. P., 1995. ‘Building data systems for cross-national comparisons of crime and criminal justice policy: a retrospective’, ICPSR Bulletin. 15:1-6.

Mugellini, G., 2012. Le imprese Vittime di Criminalità in Italia, Transcrime Report N. 16, Transcrime (Joint Research Centre on Transnational Crime) bit.ly/4cJzoMV.

National Security Private Sector Organization of Jamaica, 2010. National Security Policy Paper-Improving National Security in Jamaica.

Posas, M., 2008. Delincuencia en seguridad ciudadana y desarrollo humano en Honduras. Estudios Sobre Desarrollo Humano N. 4, Publicado por el Programa de las Naciones Unidas para el Desarrollo (PNUD) Honduras.

Sjögren, H and Skogh, G., 2004. New perspective on economic crime. Edward Elgar Publishing Limited, UK.

UNECE-UNODC 2009. Manual on Victimization Surveys. Retrieved on 15 October 2011 from bit.ly/3WAHm5a

Van Dijk, J. J. M., Manchin, R., Van Kesteren, J., Nevala, S. and Hideg, G., 2005. The Burden of Crime in the EU. Research Report: A Comparative Analysis of the European Crime and Safety Survey (EU ICS) 2005.

Van Dijk, J. J. M., Van Kesteren, J. and Smit, P., Tilburg University, UNICRI, UNODC, 2007. Criminal Victimization in International Perspective: Key Findings from the 2004-2005 ICVS and EU ICS. The Hague, Ministry of Justice, WODC.

Wagstaff, M., Dale, M., and Edmunds, M., 2006. “Redefining business crime & assessing crimes against Black & Minority Ethnic businesses in London”, Government Office for London Crime & Drugs Division.

WODC, 2011. Monitor Crime in the Business Sector. TNS NIPO, WODC.

World Bank, 1997. World Development Report. The state in a changing world.Oxford University Press.

Wrigley, E. A., 1972. Essays in the use of quantitative methods for the study of social data, Cambridge University Press.

Young, J., 2004. ‘Mayhem and Measurement in Late Modernity’, in HEUNI Crime and Crime Control in an Integrating Europe. Núm. 44: 18-30, Helsinki.

![]()

1 Para definir los países que integran Latinoamérica hemos tomado en cuenta la clasificación de las Naciones Unidas (bit.ly/4dah2o7). Ésta incluye 22 países de América Central y Sudamérica: Belice, Costa Rica, El Salvador, Guatemala, Honduras, México, Nicaragua, Panamá (América Central) y Argentina, Bolivia —Estado Plurinacional de—, Brasil, Chile, Colombia, Ecuador, Islas Malvinas, Guayana Francesa, Guayana, Paraguay, Perú, Surinam, Venezuela —República Bolivariana de— y Uruguay (Sudamérica).

2 Latin American countries are defined here according to the UNDP classification (bit.ly/4dah2o7). UNDP includes in Latin America the 22 countries belonging to Central and South America: Belize, Costa Rica, El Salvador, Guatemala, Honduras, Mexico, Nicaragua, Panama (Central America) and Argentina, Bolivia —Plurinational State of—, Brazil, Chile, Colombia, Ecuador, Falkland Islands —Malvinas—, French Guiana, Guyana, Paraguay, Peru, Suriname, Venezuela —Bolivarian Republic of—, Uruguay (South America).

3 This paper is partly based on the results of a research developed by the author for the Centre of Excellence INEGI-UNODC in February 2012 and titled “How to measure and how to use statistical data to analyse the victimization of the private sector in Latin America”.

4 For further information on the specific characteristics of the existing Business Crime Survey at European and international level (types of crime covered and methodology) see Mugellini G., 2013, ‘How to measure and how to use statistical data to analyse the victimization of the private sector in Latin America’, Centre of Excellence INEGI-UNODC.

5 Statistics collected for administrative purposes by public institutions such as the police forces, the prosecution authorities and prisons.

6 EU Business Crime Survey results, presented at the American Society of Criminology conference in Chicago, November 2012.

7 Data collected by the European Crime Victimization Survey (EU ICS) 2004/2005.

8 ICBS data (2000).

14 See bit.ly/3LydD6V

16 Any customer stealing any money or goods from the business local unit’s premises. This includes incidents of shoplifting. It does not include incidents involving violence to people or threats of such violence.

18 By ‘burglary or attempted burglary’ it is meant anyone attempting to or breaking and entering into your business local unit’s premises in order to steal something without interaction with anyone connected with the local unit (owners, employees and customers). We speak of burglary when there are traces of illegal entry, otherwise we speak of theft.

19 Anyone, while working for the company, cheating the company in terms of diverting funds, goods or services to their own purposes.

20 Any outsider, such as a customer, distributor or supplier, defrauding the company in any way: e.g. customers failing to pay the agreed price; distributors and suppliers in terms of quality or quantity of goods/services delivered.

21 The survey sampling frame refers to a complete list of the population to be studied from which the target population will be sampled.

22 The business sectors of economic activity are identified on the basis of the NACE rev. 1.1 Statistical Classification of Economic Activities.

23 Self-administered questionnaires are filled in by respondents themselves rather than by an interviewer.